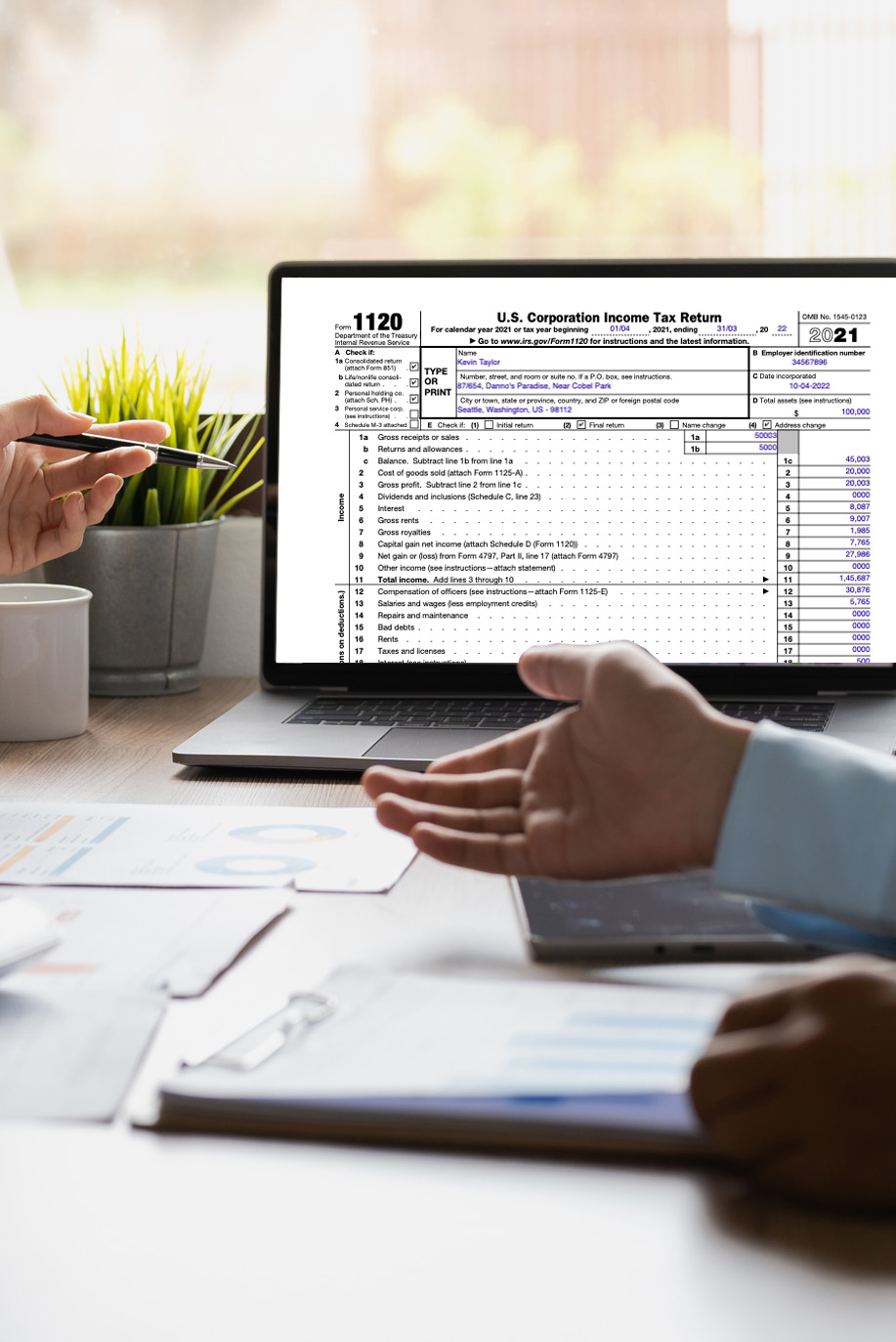

With AOTM IDP, data processing for Form 1120s is made simpler

Real-time processing of IRS Form 1120s with over 99% accuracy. With minimum setup and simple connection, AOTM can streamline your document processing activities.

Real-time processing of IRS Form 1120s with over 99% accuracy. With minimum setup and simple connection, AOTM can streamline your document processing activities.

Form 1120s is the tax form for an S-Corporation used to report the income, losses, and dividends of S corporation shareholders. It acts as the corporation’s annual income tax return granted the S-corporation stays in operation. It is a vital document needed for tax relief schemes associated with COVID-19.

Manually processing hundreds of forms per day might lead to a variety of mistakes and make the process frustratingly slow. Additionally, it raises the cost of processing overall.

AOTM assists with form 1120s processing by providing intelligent document processing solution.

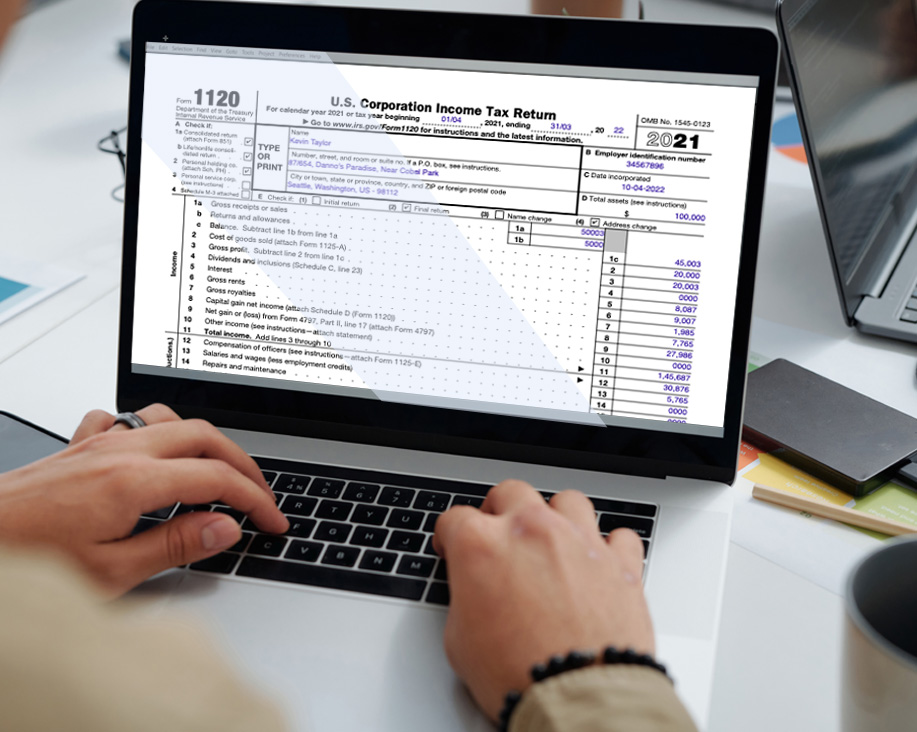

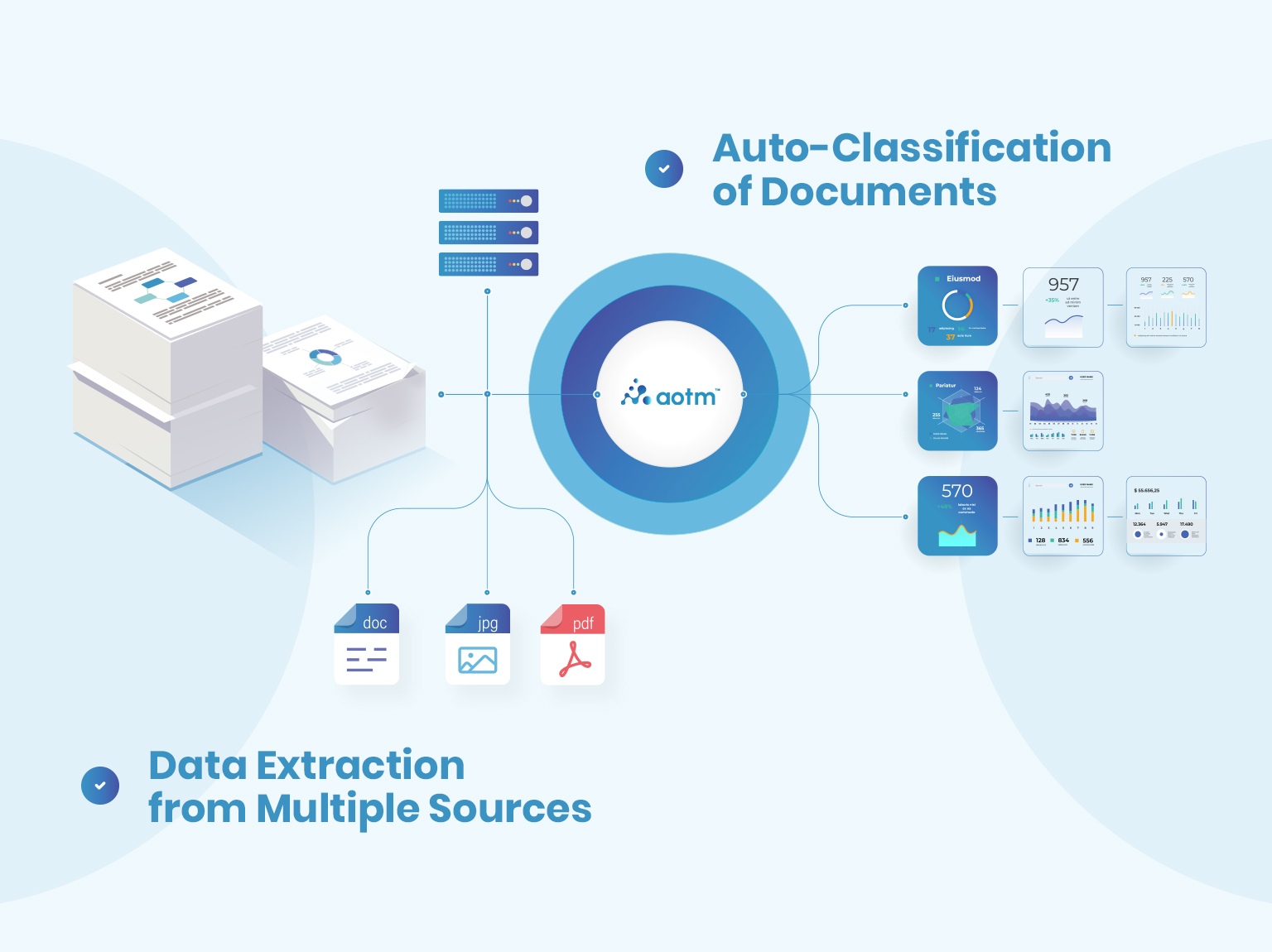

AOTM IDP solution helps automatically classify the documents making it easy for the user to sort through various documents at a time.

AOTM IDP solution assists in extracting and data processing from various formats, be it an image, PDF, or business forms.

Enhance your business flow by reducing document processing time by 85%.

Reduce data processing costs by 50% and bid goodbye to high labour costs.

Reduce the risk of human errors with AOTM Solution.