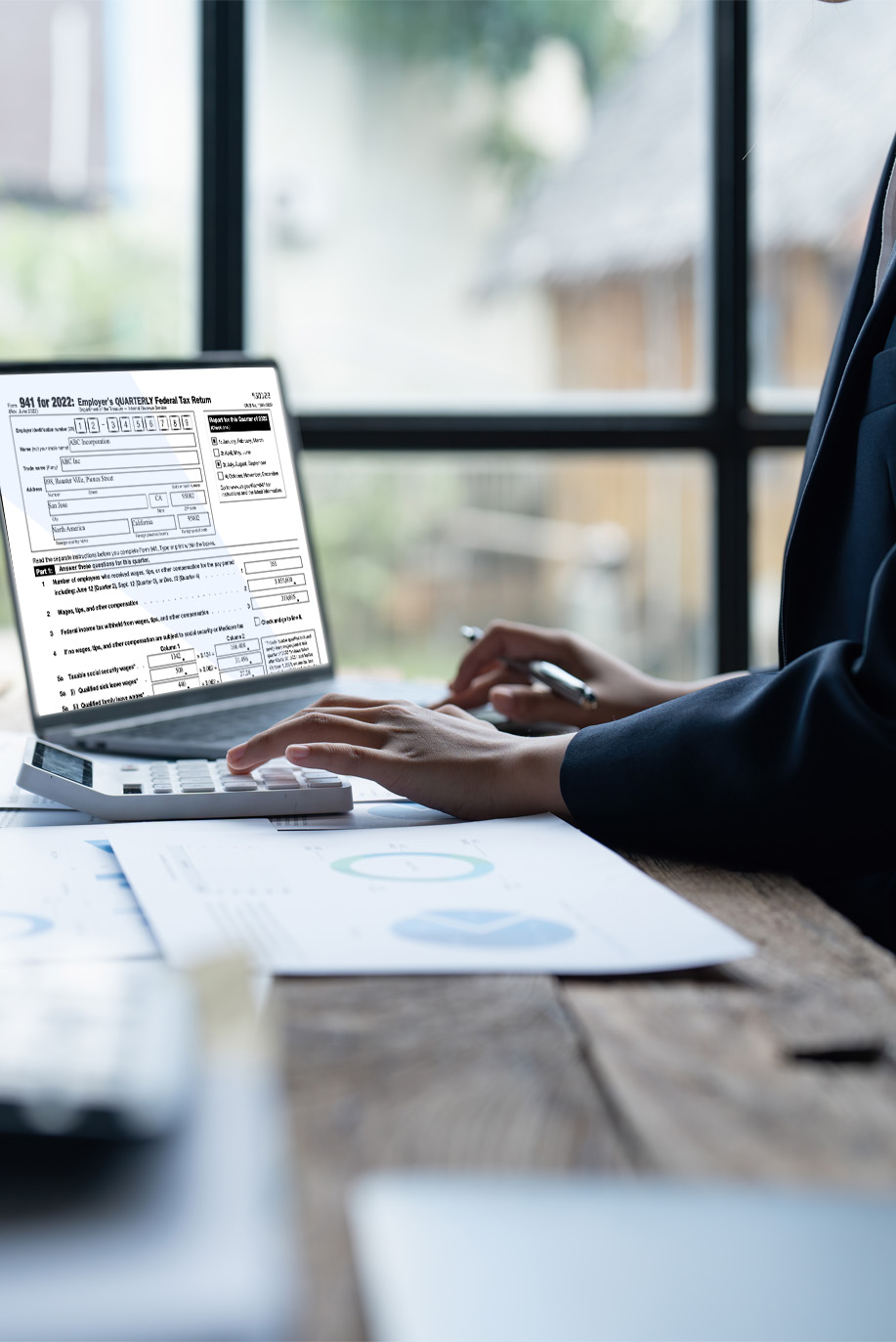

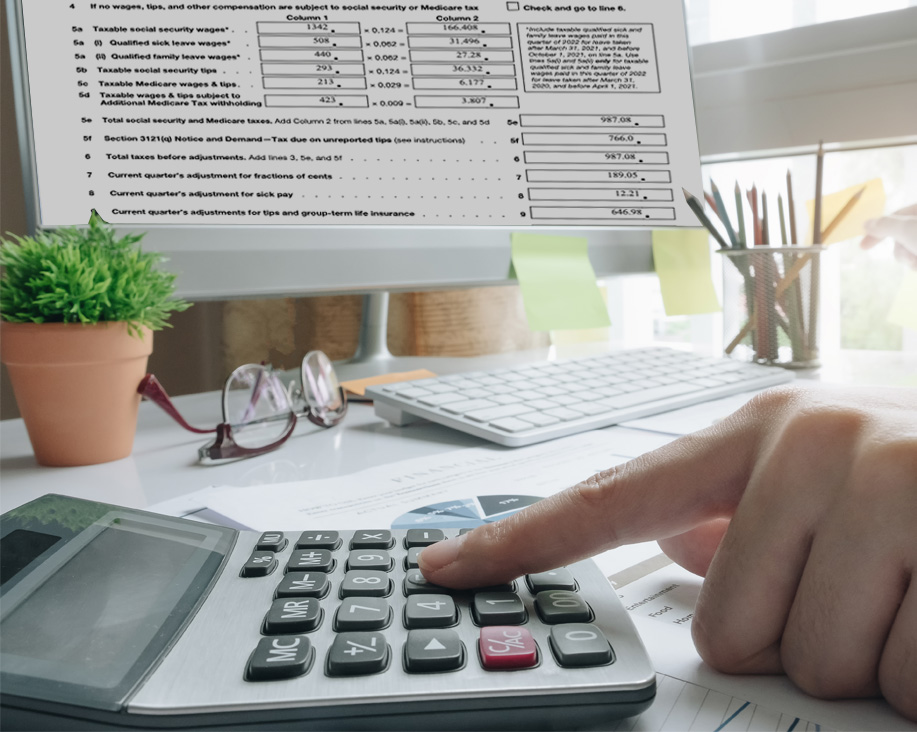

Real-time, painless data extraction from IRS Form 941 using AOTM IDP

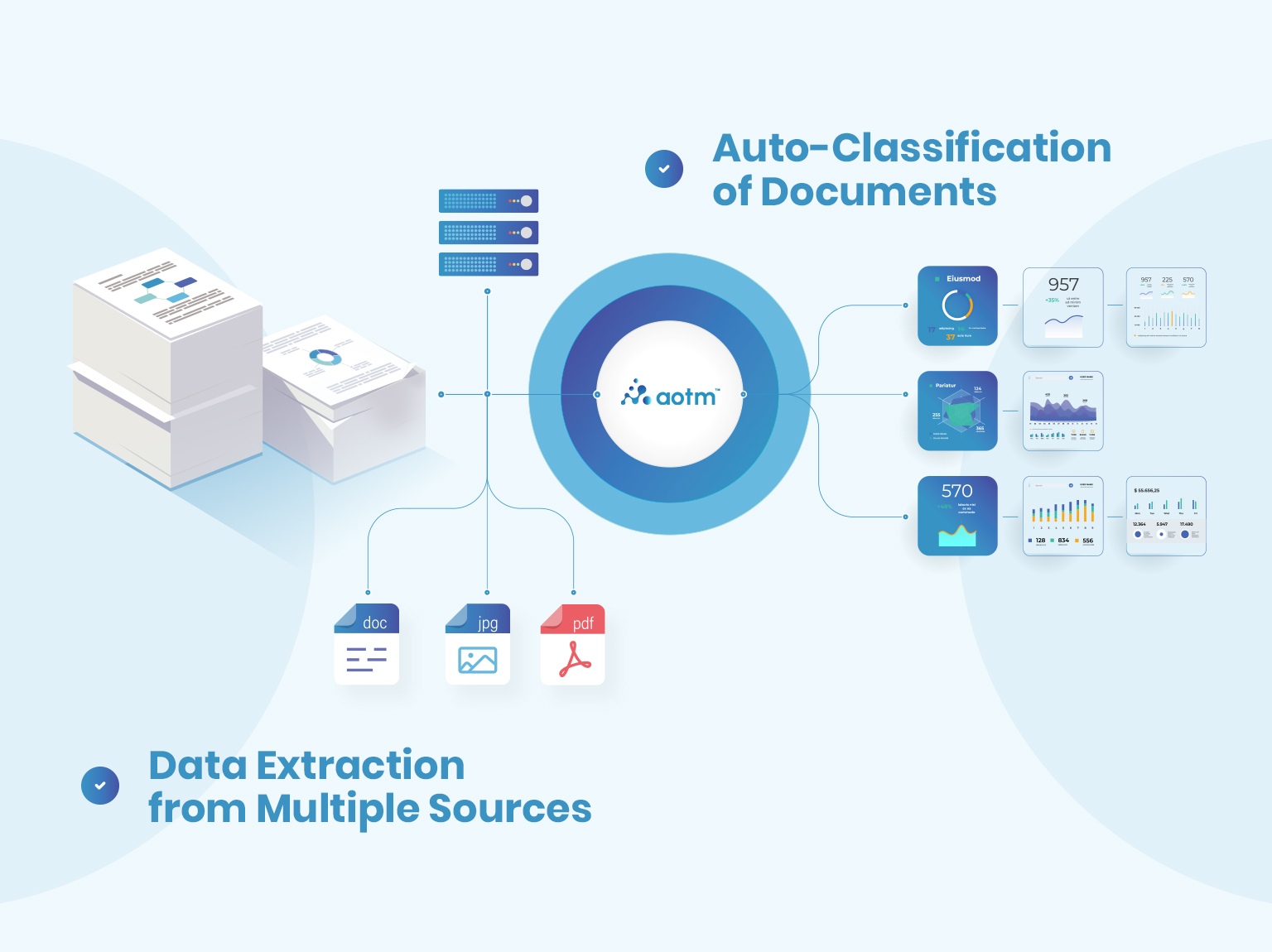

AOTM’s clever OCR technology will help you process IRS Form 941 significantly faster. Enjoy the advantages of great precision and quick turnaround. Enjoy easy data validation with little setup needed.