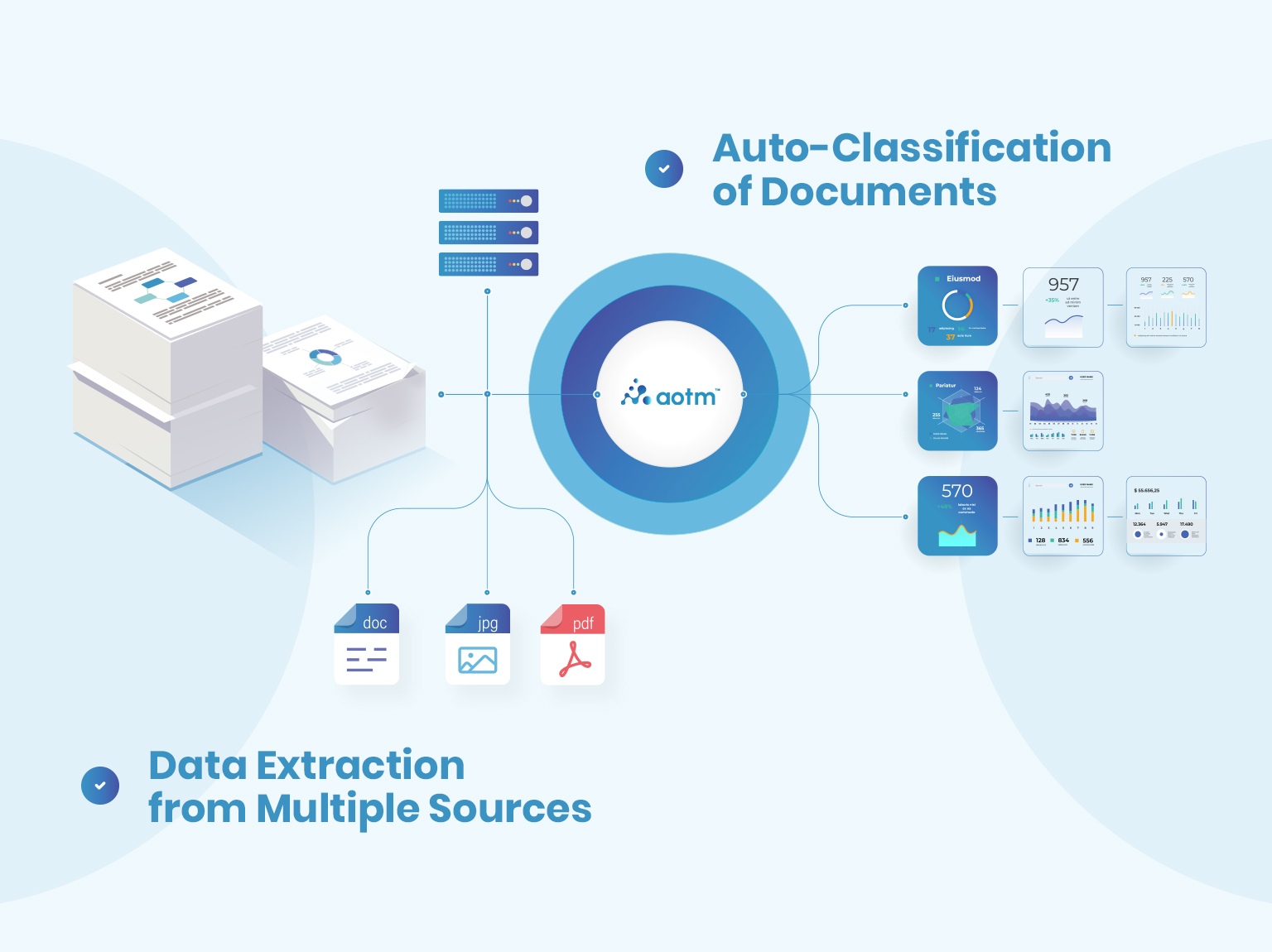

Using AOTM, automatically extract data from the IRS Form 990

AOTM’s clever OCR technology makes it significantly quicker to extract data from Form 990. Profit from enhanced accuracy and easy data validation. Benefit from quicker set up and improved turnaround time.